FROM PROFESSOR TO PICKETER: The Lost Generation and the Missing Money

Ghana is neither worth living for nor dying for. That’s how many feel at the moment. Honestly. Think about this: I’ve known Uncle Kweku since his graduate student days on the University of Ghana campus. I was only a lad then. He would later complete his graduate studies, an MPhil in linguistics, and top it up with a PhD from Oregon, USA.

After an illustrious career as an academic (see his brief bio here on the University of Ghana website) he not only retired as a full professor but even served as Pro Vice-Chancellor of Ghana’s premier university. What do we find the illustrious son of Ghana doing these days? Picketing on the premises of Ghana’s Ministry of Finance to demand that the government exempts his and fellow pensioners’ bonds from being sequestered in the dubious Domestic Debt Exchange (DDE) programme. I know for a fact that virtually all of Prof. Kweku Osam’s pension monies are in these bonds. Ei! A former Chief Justice also picketing alongside the other day is reported to have said, “I am over 70 years now. I am no longer government employed, my mouth has been unguarded, and I am talking, and I am saying that we have failed.”

“BACK TO THE FUTURE”

When Uncle Kweku overtly verbalized to the media in an interview on one of the picketing days that he would dissuade his children from ever investing in the Government of Ghana’s financial instruments because “they are risky,” he seemed to have read my mind. Seriously. For while I agree that it is despicable to draw the aged into this DDE debacle and punish pensioners who have planned well for their future and lent their own monies to government to work with, I have an even greater concern for the young people of the country who might take decades to recover from this rude shock. It has taken years to grow a savings and investment culture in Ghana.

As previously started in an earlier article on this matter, “I am pained that, ‘The fathers have eaten sour grapes, and the children’s teeth are set on edge’ (Ezekiel 18:2). For over 20 years now, The HuD Group and I have championed a culture of savings and investments in Ghana, and had the JOY of seeing thousands heeding the call, especially young people.” I recently met one of the young men I used to travel the country with to inspire and teach young people to form investment clubs and start investing. He’s currently the managing director of a major investment company in Ghana. He intimated how this whole DDE disaster made him shed several kilograms over a month, being at the receiving end of verbal and other forms of abuse from frustrated and fearful investors. At the time we spoke, people were withdrawing an average of 100 million Ghana Cedis each day from his outfit. He had already dispatched 2.5 billion Ghana Cedis when we held our conversation.

A zoom in on Prof. Kweku Osam, picketing at the Ministry of Finance, with his fellow pension bondholders

BACK TO THE PENSIONERS

So what exactly are we working for? The calibre of pensioners-turned-picketers is disheartening: doctors, engineers, civil servants… If retired professors and chief justices are protesting, what about the no-namers and the many who are too old or too ill to hit the streets? I am privy to a WhatsApp message Prof. Kweku Osam sent that was meant to be just informational, but ended up being very transformational for me:

The last time I took part in a public demonstration against a government of Ghana was in May 1983, as a fresh graduate student. That was when students in the country rose up against Rawlings and his PNDC. Today, God willing, I’ll join fellow Pensioner Bondholders to protest at the Ministry of Finance. The government should leave Pensioner Bondholders alone. Touch not the Pensioner Bondholders.

Think about it: Uncle Kweku began his working life protesting the government. Forty years later, he is ending his working life with yet another anti-government protest. Virtually all his lifesavings is now being held at ransom by a government that has misled and mismanaged her affairs, Covid-19 and Russia-Ukraine notwithstanding. After forty years of wandering in the wilderness between the 1983 protest and the present one on the eve of our sixty-sixth independence commemoration, Ghana itself is a pensioner by age, without much to show for it. We’ve got to do better for our people, old and young alike. Seriously.

Prof. Osam’s generation–my parents’ generation–is the same one the current Finance Minister, Uncle Ken, belongs to. It is the same crop of people who plotted military coup d’etats a generation ago in their youth. Now they won’t exit quietly either, not without a financial coup de grace. With trepidation, dare I call them the lost generation? And they did not only lose themselves and their way, they lost money–theirs and ours.

But to what will my generation and those following rise, having clearly observed that Ghana is not worth living for and Ghana is not worth dying for? That’s how many feel at the moment. Honestly. Think about it.

The Fathers’ Appetites Have Soured the Children’s Futures

The following slightly edited version of this article was first written and posted on Dr. Yaw Perbi’s FaceBook wall on January 31, 2023. At the time, that last day of January was the deadline to tender in eligible Government of Ghana bonds in the controversial Domestic Debt Exchange (DDE). There have been scores of passionate responses to the trending article that we have decided to reproduce it here so people are able to document these for posterity.

I am pained that, ‘The fathers have eaten sour grapes, and the children’s teeth are set on edge’ (Ezekiel 18:2). For over 20 years now, The HuD Group and I have championed a culture of savings and investments in Ghana, and had the JOY of seeing thousands heeding the call, especially young people. Financial Whizzdom, is what we called the campaign.

I wrote three personal finance books and executed a triple launch of Financial Whizzdom, Financial Whizzdom Nuggets (a summary) and Financial Whizzdom through Investment Clubs. It was around that time that Uncle Ken became a mentor to me. He was intrigued that a medical student would be so adept at the world of finance. He not only loaned us some money to finish the project (which we fully paid back within three months or so) but he also passionately spoke at the triple launch. The year was 2004.

Many like-minded people came together to push a savings and investments culture among young people. We traveled the length and breadth of Ghana, doing several seminars and workshops. Medics Investment Club (which really is the first investment club in Ghana per the National Association of Investment Clubs definition) became a model for many who also started their own investment clubs around the country, from university campuses and nursing training colleges to even secondary schools. No wonder I’ve been christened “the grandfather of investment clubs in Ghana.”

The many who wanted to join our investment club at the University of Ghana Medical School but who couldn’t (we had set the maximum for 20) were mobilized into a collective investment scheme we called ‘Mutual Medics.’ At the peak we grew to about 300. We sacrificed student loans, ice cream money and even extra-curricular fun and entertainment to save for our future. Almost none of us have withdrawn the monies we invested almost two decades ago.

Today, January 31, 2023, is the deadline for the trustees of this mutual investment scheme we set up way back in our medical school days to inform Databank for sure whether or not to tender in our eligible bonds in the Government of Ghana’s Domestic Debt Exchange (DDE) debacle. Our fund managers had 70% of the total value of the fund in government bonds, which in normal times and normal places with normal people are supposed to be very low risk, even tempting some advisors to say ‘no risk’ (nothing is ‘no risk,’ not even life itself!).

This DDE is supposed to be a voluntary move but in reality it is a case of “choose your poison.” If you drink this one you will die, if you drink the other one, you will surely die. I am pained for myself, colleagues, fund managers, and the whole investment fraternity in Ghana, especially the younger generation. How did we get here? Indeed, ‘The fathers have eaten sour grapes, and the children’s teeth are set on edge.’

Even more heart-wrenching is that if this should happen under any Finance Minister’s regime, not under the watch of the very mentor who, as far as I know, has spent his whole life building the very financial culture, structures and systems that seem to be now crumbling at his hitherto dextrous hands. The irony.

I am pained. Very much. Whoever has eaten our money, killed our dreams, buried our hope and compelled us to come for unfashionable haircuts that make us look like our misery will have to make it up to us, somehow, even if it is their children or their children’s children. In the mean time, ‘The fathers have eaten sour grapes, and the children’s teeth are set on edge.’ Ah!

~By Dr. Yaw Perbi

Photo credit: Opinion Nigeria

Post Script

We shall do well to document as many of the responses we’ve garnered so far as possible. This issue warrants a national conversation, at the least. A national demonstration for all those equally pained might also be in order to send a strong message to the current government, who in spite of all the pain they are inflicting on the citizenry, have shown no significant sense of regret, repentance or even austerity.

The Little Cow

The first time I heard the story about the little cow, it was from the lips of a millionaire. Gathered in the conference room of some hotel in mid-town Montrèal, this man who had made his money from the financial services industry was urging us on to let go of our little cows, mainly JOBs (which people in his circle called “Just Over Broke”) and go chasing those dreams that will stretch us, pain us but in the end be most gratifying.

Recently, I decided to search online for the story and finally found it, author unknown. Here goes.

The Little Cow – Unkown Author

A master of Wisdom was traveling through the countryside with his apprentice when they came to a small, disheveled shack on a meagre piece of farmland. “See this poor family,” said the Master, “Go see if they will share with us their food.”

“But we have plenty,” said the apprentice.

The master said, “Do as I say.”

The obedient apprentice went to the home. The good farmer and his wife, surrounded by their seven children, came to the door. Their clothes were dirty and in tatters.

“Fair greetings,” said the apprentice, “My Master and I are sojourners and want for food. I’ve come to see if you have any to share.”

The farmer said, “We have little, but what we have we will share.” He walked away, and then returned with a small piece of cheese and a crust of bread. “I am sorry, but we don’t have much.” The apprentice did not want to take their food but did as he had been instructed. “Thank you. Your sacrifice is great.”

“Life is difficult,” the farmer said, “but we get by. And in spite of our poverty, we do have one great blessing.”

“What blessing is that?” asked the apprentice.

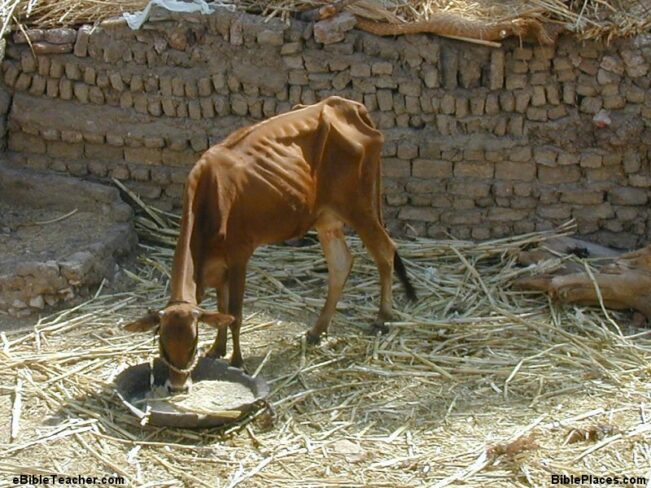

“We have a little cow. She provides us milk and cheese, which we eat or sell in the marketplace. It is not much but she provides enough for us to live on.”

The apprentice went back to his Master with the meagre rations and reported what he had learned about the farmer’s plight. The Master of Wisdom said, “I am pleased to hear of their generosity, but I am greatly sorrowed by their circumstance. Before we leave this place, I have one more task for you.”

“Speak, Master.”

“Return to the shack and bring back their cow.”

The apprentice did not know why, but he knew his Master to be merciful and wise, so he did as he was told. When he returned with the cow, he said to his Master, “I have done as you commanded. Now what is it that you would do with this cow?”

“See yonder cliffs? Take the cow to the highest crest and push her over.”

The apprentice was stunned. “But Master…”

“Do as I say.” The apprentice sorrowfully obeyed. When he had completed his task, the Master and his apprentice went on their way.

Over the next years, the apprentice grew in mercy and wisdom. But every time he thought back on the visit to the poor farmer’s family, he felt a pang of guilt. One day he decided to go back to the farmer and apologize for what he had done. But when he arrived at the farm, the small shack was gone.

Instead there was a large, fenced villa.

“Oh no,” he cried, “The poor family who was here was driven out by my evil deed.” Determined to learn what had become of the family, he went to the villa and pounded on its great door. A servant answered the door.

“I would like to speak to the master of the house,” the apprentice said.

“As you wish,” said the servant. A moment later a smiling, well-dressed man greeted the apprentice.

“How may I serve you?” the wealthy man asked.

“Pardon me, Sir, but could you tell me what has become of the family who once lived on this land but is no more?”

“I do not know what you speak of,” the man replied, “my family has lived on this land for three generations.”

The apprentice looked at him quizzically. “Many years ago I walked through this valley, where I met a farmer and his seven children. But they were very poor and lived in a small shack.”

“Oh,” the man said smiling, “that was my family. But my children have all grown now and have their own estates.”

The apprentice was astonished. “But you are no longer poor. What happened?”

“God works in mysterious ways,” the man said, smiling. “We had this little cow that provided us with the slimmest of necessities, enough to survive but little more. We suffered but expected no more from life. Then, one day, our little cow wandered off and fell over a cliff. We knew that we would be ruined without her, so we did everything we could to survive. Only then did we discover that we had greater power and abilities than we possibly imagined and never would have found as long as we relied on that cow. What a great blessing from Heaven to have lost our little cow.”

COW & COIN CONCLUSION

Everyone of us has a little cow that stands in the way of fulfilling our full potential. So what’s your little cow? Now imagine a little child who remains tight-fisted over a quarter, a 25-cent coin, when you are eager to give them a $100 bill you’re hiding behind you and encouraging them to ‘open up’ and ‘let go’ of the quarter to receive. They aren’t able to receive the $100 because they would rather keep the little that’s surely in hand than open their palm and risk losing the quarter, although they might very well know that what they could gain might be way better.

You probably have heard it said that often the enemy of the best is the good. What is your little coin or little cow. Let it go; kill it!

Nigeria is Too Important to Fail

Leaders and organizers of the Africa Impact Forum in February 2020 (Photo credit: Africa Leadership Initiative)

What a year for Black folk! From police brutality in the United States of America (USA) to same in the western region of Africa, White on Black, Black on Black, what a year! One would think that having commemorated 2019 as 400 years after the first Black slaves set foot in what is now the USA the news wouldn’t smell of Black beatings and lynchings and treatment as less than human any longer but here we are. In this season we’ve had the luxury of both time (thanks to COVID-19) and technology to etch these news clips into our consciences and reveal to us not only where we stand but even more deeply, who we are.

On the last day of this year’s Africa Impact Forum (February 26-29) for fellows of the Africa Leadership Initiative, a part of the Aspen Global Leaders Network, my heart was really stirred by Olara Ottunu, Ugandan diplomat, lawyer and politician. He was Uganda’s Permanent Representative to the United Nations from 1980 to 1985 and was the United Nations Under-Secretary-General and Special Representative for Children and Armed Conflict from 1997 to 2005. Olara Ottunu minced no words in the final plenary that there can be no African prosperity without Nigeria and the Democratic Republic of Congo doing well. These ‘big boys’ are the most populous Anglophone and Francophone nations on the 55-state continent of Africa. I have since not looked at Nigeria the same way. Nigeria is too important to fail.

If Black Lives Matter, then the most populous Black country on earth matters immensely. Altogether the over 200 million Nigerian people of 300 tribes matter; individually, each person matters. And by the way, Nigeria will overtake the United States to become the third-most populous country in the world by 2050, surpassing the 300 million people mark, according to a United Nations report. The current seventh most populous country in the world is not only rich in people but also oil and other natural resources. This goes without saying.

Boasting of one of the most vast African Diaspora populations in the world, I have personally had the pleasure of forging deep friendships with Nigerians at medical school in Ghana and as president of International Students Ministries Canada today, delight to see them shine among the top 10 sending countries of international students to Canada. If Africa is the most numerically Christian continent in the world today, it is significantly in part due to Nigeria’s over 90 million strong Christian population.

When Africa’s largest market of 200 million people (twice the size of Ethiopia’s 110 million or Egypt’s 102 million) surpassed South Africa to become the continent’s largest economy as well last year, the business experts had to admit, “Now It’s Too Big for Businesses to Ignore.” Why do you think the United States and United Kingdom have over $55 billion in foreign direct investments in Nigeria, with the Chinese following close after France? Not to mention Italy, India, South Africa, Singapore and Switzerland.

NIGERIA IS WORTH SAVING

When George Floyd was slowly slaughtered before the eyes of a watching world and protests erupted all over the United States and around the world, one of the most profound things I heard was that if Africa had upped her socio-economic game many African-Americans would’ve rather returned ‘home’ than suffer such indignity in the U.S. Even then for some, freedom and dignity matter more than economics, so have responded to overtures from governments like Ghana’s to ‘come home.’ “We want to remind our kin over there that there is a place you can escape to,” said Akwasi Agyeman, chief executive of the Ghana Tourism Authority. “That is Africa.” Now, if I may ask, what is the sense in Blacks escaping police brutality in America, crossing the expansive Atlantic, only to come ‘home’ to the same police brutality, Black on Black?

I am very proud of the display of Youth Power! that has called for #EndSARS and indeed has succeeded in the dissolution (on 11th October, 2020) of the Special Anti-Robbery Squad (SARS) of the Nigeria police which has meted out unspeakable crimes against the citizens of Nigeria. Now some protests are deteriorating into rioting while law enforcement is metamorphosing into death squads firing live ammunition into crowds. As Global CEO of The HuD Group, with HuD Nigeria as one of our strong networks, we demand that elected officials as well as the teeming youth be response-able (responsible) and remember that they hold the dignity and prosperity of the entire Black race in their hands.

All nations matter but not all nations are equally strategic. You would think some of the reasons given above why Nigeria is too important to fail are rather carnal but once upon a time when God Himself wanted to save a certain nation from destruction His reason for sending them a prophet to save them from themselves was pretty intriguing: “And should not I pity Nineveh, that great city, in which there are more than 120,000 persons who do not know their right hand from their left, and also much cattle?” (Jonah 4:11) The numbers of humans matter, the natural resources matter. Nigeria is too big and too important to fail. #PRAY FOR NIGERIA!

Life begins BEFORE 40, for sure!

On 16th March, 2017, I turned 39. I give thanks and praise to God! Yet barely 24 hours prior I was a little discouraged. No, not a midlife crisis 🙂 My disappointment came from discovering a negative CAD 4,839.01 hole in my ministry account. I’ll tell you why.

THANK YOU FOR 38TH

All thanks and praise to God, last year around my 38th birthday we launched a campaign to raise $10,000 between March and June for all the Lausanne Movement assignments thrust upon me in 2016. And guess what? WE DID IT! Thanks to people like you, we raised slightly more than the $10k target and I was not only able to fulfill all the Lord’s tasks in Europe (Czech Republic), North America (US/Canada), Africa (Ghana), Asia (Indonesia), and Latin America (Panama) but was even able to do a couple of these missions with my dear wife and partner for life, Anyele. Thank you! Thank you! Thank you! The seeds sown from those initiatives are still blossoming and bearing fruits.

AND NOW…

As I enter my 40th year of life this week I’m already thinking LEGACY—how you and I will be remembered after we’re long gone. How will our lives continue on, even though we are dead? Martin Luther King Jnr. died at 39, at my age today, shot in the jaw while readying himself to lead one of his characteristic civil rights marches. What if Luther King had said, “Life begins at 40?” His short life but long legacy is still celebrated today, decades later, all over the world.

For a 40th year legacy project, my aim is to raise CAD 40,000 ($4,000 for every decade of my life) over the next 24 months, from 16th March 2017 to 15th March 2019 for what I believe is the greatest legacy you and I can ever leave: godly, effectual global servant-leaders deeply transformed to transform nations and generations. This means raising only CAD 1,667 each month for the next 2 years. Will you contribute to the President’s Scholarship for Global Leadership?

One of my favourite leaders, Peter Scazzero, author of The Emotionally Healthy Leader, puts this task bluntly: “We must train the next generation for leadership. The world population is now 7.2 billion people. It will be 8.5 billion in 2030 and 9.7 billion people by 2050. Think about that: We will add 2.5 BILLION people in the next 33 years! Who will be the apostles, prophets, pastors, teachers and evangelists to equip these additional 2.5 billion people?” And to think that even today there are 3.5 billion people in our world still to be transformed with the Gospel of Jesus Christ! Each of us will need to reevaluate our lives and adjust our “wineskins and priorities to meet this acute need.” WHO will you contribute to this task?

STARTING WITH ME

I am offering the ‘second half’ of my life as a living sacrifice to God and you for this task. Half of this CAD 40,000 will be an investment in Yaw Perbi towards academic rigour, deeper spiritual formation and reflective praxis so I may ‘reproduce after my kind’ for the task unfinished.

It has been nine years since surviving that fateful accident in Cote d’Ivoire (above) after which I felt the Lord calling me to fully devote my life to preaching the gospel and raising younger leaders. And “I was not disobedient to the heavenly vision.” Thus far, there has been no formal academic training in theology, missiology or leadership. There surely has been a lot of on-the-job learning and doing from a place of clear calling, vision and pure passion. It is now time for critical reflection of self and praxis, solid biblical theological training to undergird my call and academic rigour to complement what is already natural and supernatural about this calling.

AM I WORTH THIS INVESTMENT?

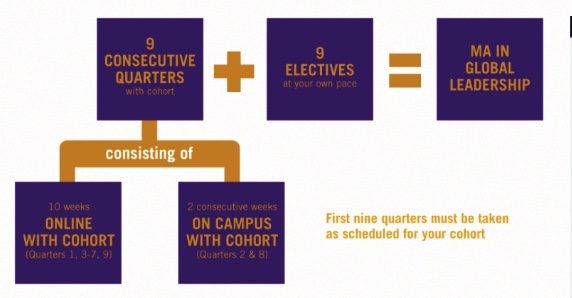

So, a few months ago I took the plunge and was accepted into the prestigious Fuller Seminary’s Master of Arts in Global Leadership. Having been pouring and pouring into others, it was refreshing to put together a comprehensive Learning Plan for myself. It has been a rich soul-searching experience for one who is more of a doer than a reflector. My transformation is affecting everything about me including slowing down for loving union with Jesus and leading out of the strength of my marriage. The organisations I lead are on the path of deeper discipleship and emotionally healthy leadership as a result.

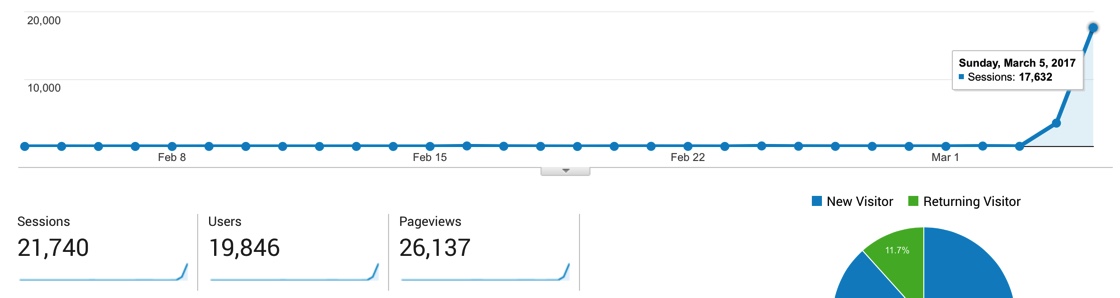

And you know an investment in Yaw Perbi affects tens of thousands more. Only last week, a reflection I did on “When Life Doesn’t Make Sense” based on some of my MAGL learning so far reached over 30,000 people on FaceBook and over 26,000 hits on my personal website! You decide; if investing $20,000 in me is worth it or not. With the aforementioned example alone, that’s less than $1 investment per person impacted!

QUALITY EDUCATION IS COSTLY

Fuller is no doubt ‘the Harvard of seminaries,’ with a 70-year record of producing great leaders of our time like Rick Warren. With 4,000 students enrolled online and on 7 campuses from 90 countries and 110 denominations, Fuller is the largest multidenominational seminary in the world!

A course at Fuller costs USD 1,200; it isn’t cheap. I have negotiated a deal for ISMC so that any of our staff could get a 30% discount, bringing this amount to USD 840. Unfortunately, the drop of the Canadian dollar to the US dollar by about 30% sends us back to paying nearly the same USD 1,200 still. The MAGL consists of 9 core courses taken in sequence with the rest of my cohort from around the world and 9 electives, resulting in a total of USD 15,120 or CAD 19,656 (not counting books and travel and lodging expenses over the two years).

So far, I have invested nearly CAD 5,000 having taken 3 courses (including one on-campus session) and scored A+ in each! Praise God! That largely explains the gaping -$4,839.01 hole in my ministry account from which I serve the cause of international students globally and from which I get paid!

THE ASK—A GIFT THAT KEEPS GIVING

The other half of this legacy project is to provide SEED to invest in other staff and international students towards their leadership development including setting up a Global Leadership Incubator and a Leadership Institute. The task unfinished is great and urgent!

I invite you to give to the President’s Scholarship for Leadership. If 17 people sign up to give CAD 100 monthly we’ll meet the full target in 24 months. You may also decide to sponsor me for a whole course (CAD 1,200). If you have access to a foundation or other scholarship scheme that can offer grants of multiple thousands of dollars that will be awesome too. Please let me know.

Whatever you do, please make some contribution to the day of my birth and the birth of many multiple global leaders as a result–a gift that keeps giving towards the task unfinished.

Thank you for investing in hundreds of thousands of lives to begin and flourish before 40! Give HERE.

Pourquoi ai-je acheté une maison avant même d’acheter une télé ?

Puisque le voyage pour l’indépendance financière prendra plus de temps que vous ne le pensiez et sera plus difficile que vous ne l’imaginiez, le moins que vous puissiez faire est de «définir vos priorités», pendant cette Noël !

QUEL NOEL? PAPA NOEL!

Youpi, c’est encore Noël ! C’est l’une de ces fêtes d’anniversaire étranges où on ignore carrément celui est à l’honneur. Il est plus question des fêtards en lieu et place du concerné même de l’anniversaire.

L’une des raisons pour lesquelles il est plus question du Père Noel et non pas vraiment de Jésus-Christ, Dieu dans la chair né à Bethléem comme un bébé – c’est que «Noël est généralement une haute saison de vente pour les commerçants dans de nombreux pays du monde. Les ventes augmentent considérablement au fur et à mesure que les gens achètent des cadeaux, des décorations et des provisions pour célébrer la fête». Aux États-Unis, par exemple, on estime qu’un quart de toutes les dépenses personnelles se font pendant la période de Noël.

Le secteur du commerce en détail des États-Unis a généré plus de trois milliards de dollars américains pendant les congés de Noel en 2013. La valeur des aliments et des boissons achetés par les grands détaillants au Canada en décembre 2014 était de 4,6 milliards de dollars.

UNE CONFESSION

Voyons Noël 2014. La valeur des téléviseurs et du matériel audiovisuel achetés chez les grands détaillants au Canada en décembre s’est élevée à 543,2 millions de dollars! Sachez-le, je ne suis pas un grand fan de télévision ou d’écran géant. De toute ma vie, jusqu’à il y a à peine trois ans, je n’avais jamais acheté de télévision. Avant cela, chaque télévision en notre possession dans ma maison conjugale nous avait été offerte. Chose intéressante, pour moi, concernant les premiers téléviseurs que nous avons achetés avec notre propre argent, c’est que lorsque nous avons acheté notre maison en 2013, nous y avons trouvé deux téléviseurs écran plat installés dans la maison. D’ailleurs, c’était la deuxième maison que nous venions d’acheter dans deux différents pays.

UN CREDO

Pourquoi cet ordre? Ceux parmi vous qui me connaissez bien sont conscients du fait que depuis 15 ans, je recherche de la Financial Whizzdom (l’art des finances). L’un des premiers principes que j’ai pris de l’auteur de Père Riche Père Pauvre, Robert Kiyosaki, est le fait d’acheter d’abord des actifs (quelque chose qui met de l’argent dans votre poche) avant d’aller vers les passifs (quelque chose qui sort de l’argent de votre poche).

J’aime la façon dont Kiyosaki clarifie cela pour ceux qui veulent polémiquer sur cette «définition» de l’actif et du passif: «si vous arrêtiez de travailler aujourd’hui, vos actifs vont vous nourrir; vos passifs vont vous bouffer». Est-ce plus clair? Les deux biens immobiliers que je viens de mentionner mettaient de l’argent dans nos poches d’une manière ou d’une autre. Et les téléviseurs? Bon…

Il y a eu des moments où je n’ai pas respecté mon credo, mais c’était important d’avoir à l’esprit et la discipline de produire d’abord des actifs et les passifs plus tard par rapport au fait d’avoir une télévision, du moins à mon avis. Définir ses priorités.

Parfois, je regarde avec une stupéfaction totale les jeunes possédants des passifs somptueux, surtout quand c’est un double passif en ce sens qu’ils achètent aussi ces objets à crédit!

LE NOËL DE DEMAIN!

Si jamais vous avez l’intention d’être financièrement indépendant – avoir un revenu passif n’excédant pas vos frais de subsistance de sorte que nous n’ayez pas à travailler toute votre vie – je vous assure qu’il vous faudra plus de temps que vous ne l’imaginer et cela vous coûtera plus que vous ne le pensez. Croyez-moi, cela fait plus de 15 ans que je suis dans cette aventure ; je sais de quoi je parle. Après plusieurs entreprises et de nombreux investissements dans plusieurs pays, je suis encore sur le chemin. Je n’y suis pas encore arrivé. Si vous vous serrez un peu la ceinture pendant cette Noël et celles à venir, vous obtiendrez sûrement des ressources de vos actifs pour vous nourrir et vous faire plaisir … pour la vie!

Je n’ai pas l’intention d’être un rabat-joie de la Noël. Je ne suis pas non plus partisan des mouvements Noel Sans Achats ou N’Achetez Rien. Tout ce que je dis, c’est qu’il faut fêter Noël d’une manière qui vous permettra de profiter d’autant de Noëls que le Seigneur vous permettra de vivre en bonne santé fiscale et physique.

Ma famille et moi allons profiter de Noël, donner et recevoir des cadeaux. Cette carte de Noël au début de mon article a été envoyée à nos clients et investisseurs par l’une de nos entreprises familiales, Adeshe Real Estate. Nous sommes sûrs de profiter et de partager Noël … mais en ayant aussi l’avenir à l’esprit. Au moment même où je suis en train d’écrire cet article, j’ai passé une grande partie de cette semaine à être un père au foyer parce que ma chère femme est absente. Elle est aux États-Unis pour conclure quelques marchés immobiliers.

Lorsque j’étais conseiller financier agréé à Investors Group il y a quelques années avec seulement environ un million de dollars en actifs à gérer à l’époque, c’était ahurissant pour moi de voir à la fin qu’il y avait autant de familles avec «plus de mois que d’argent.» Pourtant cette Noel, ‘tout le monde’ va dépenser comme s’il n’y aurait pas de lendemain. Vous ne souhaitez pas qu’à la fin vous vous retrouviez avec plus de vie que d’argent! Alors Définissez vos priorités. Joyeux Noël!

Translation: Timothée Zana Ouattara

Why I bought a house before ever buying a TV

Since the journey to financial freedom will take you longer than you think and be tougher than you envisage the least you could do is to put ‘first things first,’ even this Christmas!

WHAT CHRISTMAS? CLAUSMAS!

Yay it’s Christmas again! It’s one of those strange birthday parties where the birthday celebrant is largely ignored; it’s more about the partiers than the birthday bloke.

One reason why it’s more like SantaClausmas—than really about Jesus Christ, God-in-flesh born as a baby in Bethlehem—is because “Christmas is typically a peak selling season for retailers in many nations around the world. Sales increase dramatically as people purchase gifts, decorations, and supplies to celebrate.” In the U.S. , for example, it has been calculated that a quarter of all personal spending takes place during the Christmas shopping season.

The United States’ retail industry generated over three trillion U.S. dollars during the holidays in 2013. The value of food and beverages alone purchased at large retailers in Canada in December 2014 was $4.6 billion.

CONFESSION

Consider Christmas 2014. The value of televisions and audio and video equipment purchased at large retailers in Canada that December alone amounted to $543.2 million! Granted; I’m not a big television or silver screen fan. I never bought a television in my entire life until only about three years ago. Prior to that, every television we had owned in my marital home had been a gift. The cool thing, for me, about the first television sets we bought with our own money is that we got two flat screen TVs installed in a house we bought in 2013. That, by the way, was the second house we had purchased in two different countries.

CREED

Why this order? Those of you who know me well are aware that for the past 15 years I’ve been on a quest for Financial Whizzdom. One of the early principles I picked up from Rich Dad Poor Dad author, Robert Kiyosaki, was to first buy assets (something that puts money in your pocket) before going after liabilities (something that takes money out of your pocket).

I love the way Kiyosaki clarifies this for those who want to get argumentative about this ‘definition’ of assets and liabilities: “if you stopped working today your assets will feed you; your liabilities will eat you.” Clearer? Both real estate properties I just mentioned were putting money into our pockets in a variety of ways. And the televisions? Well…

There have been times when I’ve contravened my creed but it’s a good thing we had the mindset and discipline to do assets first and liabilities later when it came to getting a television, at least. First things first.

Sometimes I watch with utter amazement the lavish liabilities shown of by many young people, especially when it’s a double liability because these things have been bought on credit as well!

TOMORROW’S CHRISTMAS!

If you ever intend to be financially free—having passive income exceeding your living expenses thus not having to work at a job all your life—I can assure you that it will take longer than you envisage and will cost you more than you think. Trust me, I’ve been on this journey for over 15 years; I know. After several companies and umpteen investments in multiple countries I’m still en route. I’m not there yet. If you squeeze yourself a little this Christmas and the next few ones, you could really have resources from your assets feeding you and fanning your fun… for life!

I don’t intend to be a Christmas killjoy. Neither am I an advocate for the Buy Nothing Christmas or Buy Nothing Day movements. All I’m saying is that spend this Christmas in a way that will enable you to enjoy as many Christmases as the Lord will allow you to see in great fiscal and physical health.

My family and I will be enjoying the Christmas, giving and receiving gifts. That Christmas card at the beginning of my article is one sent by one of our family’s companies, Adeshe Real Estate, to our clients and investors. We sure are enjoying and sharing Christmas… but with the future in mind as well. Even as I write this, I’m being a stay-at-home dad for much of this week while my dear wife is away in the U.S. closing a couple of real estate deals.

When I was a licensed financial advisor at Investors Group a few years ago with only about a million dollars in assets under management then, it amazed me how many families had “more month at the end of their money.” Yet this Christmas, ‘everyone’ will shop as if there was no tomorrow. You don’t want to have more life at the end of your money! Put first things first. Merry Christmas!